Have you considered the new ATO requirements for recording your Work from Home hours?

Did you know that there has been changes to the rates for Working from Home deductions?

Hey guys, Nathan here, and as we start to get some enquiries to complete our client’s 2022/2023 Income Tax Returns, I thought I would revisit these changes.

As we all know, the way we work has drastically changed over the past couple of years. The COVID-19 pandemic has accelerated the adoption of remote work, and many of us have found ourselves working from home more frequently.

If you’ve been working from home during the 2022/2023 financial year, you may be eligible to claim deductions for your work-related expenses. However, it’s important to be aware of the recent changes announced by the Australian Taxation Office (ATO) in March 2023. Let’s dive into the details:

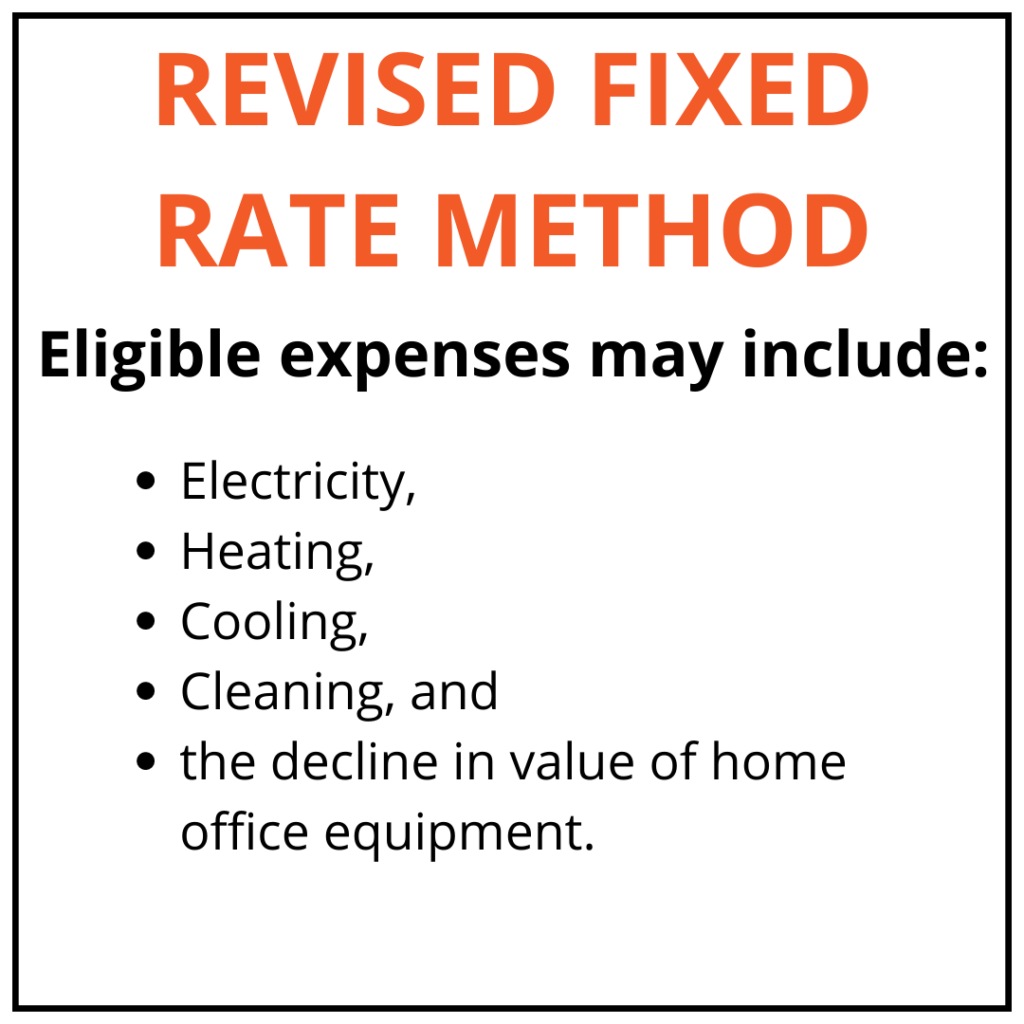

Revised Fixed Rate Method

Starting from March 2023, the ATO has introduced the Revised Fixed Rate Method, which simplifies the process of claiming deductions for work-from-home expenses. Under this method, you can claim 67 cents per hour for every hour you work from home.  By using this method, you no longer need to calculate specific expenses individually, making it much more straightforward to claim your deductions. However, you will need to maintain a diary of these hours that you do work from home. See below Changes to Record Keeping.

By using this method, you no longer need to calculate specific expenses individually, making it much more straightforward to claim your deductions. However, you will need to maintain a diary of these hours that you do work from home. See below Changes to Record Keeping.

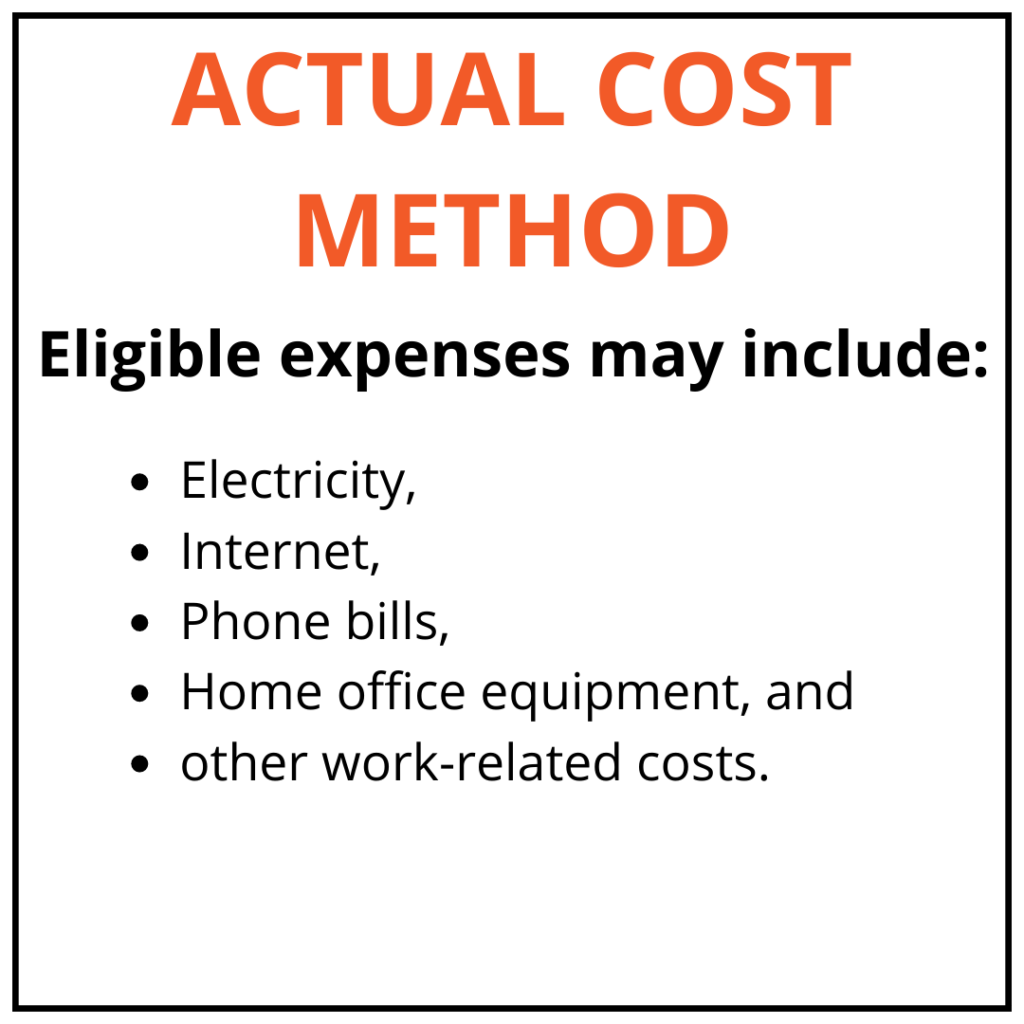

Actual Cost Method – Claiming Your Specific Expenses

If you prefer to claim your actual expenses rather than using the fixed rate method, you can still opt for the Actual Cost Method. This method allows you to claim deductions for the actual expenses you incur because of working from home.  To claim using the Actual Cost Method, it’s essential to keep accurate records of your expenses throughout the year. This can be achieved through receipts, invoices, or other documentation that clearly shows the costs you’ve incurred. While this method requires more record-keeping, it may result in higher deductions if you have substantial work-related expenses.

To claim using the Actual Cost Method, it’s essential to keep accurate records of your expenses throughout the year. This can be achieved through receipts, invoices, or other documentation that clearly shows the costs you’ve incurred. While this method requires more record-keeping, it may result in higher deductions if you have substantial work-related expenses.

Changes to Record Keeping

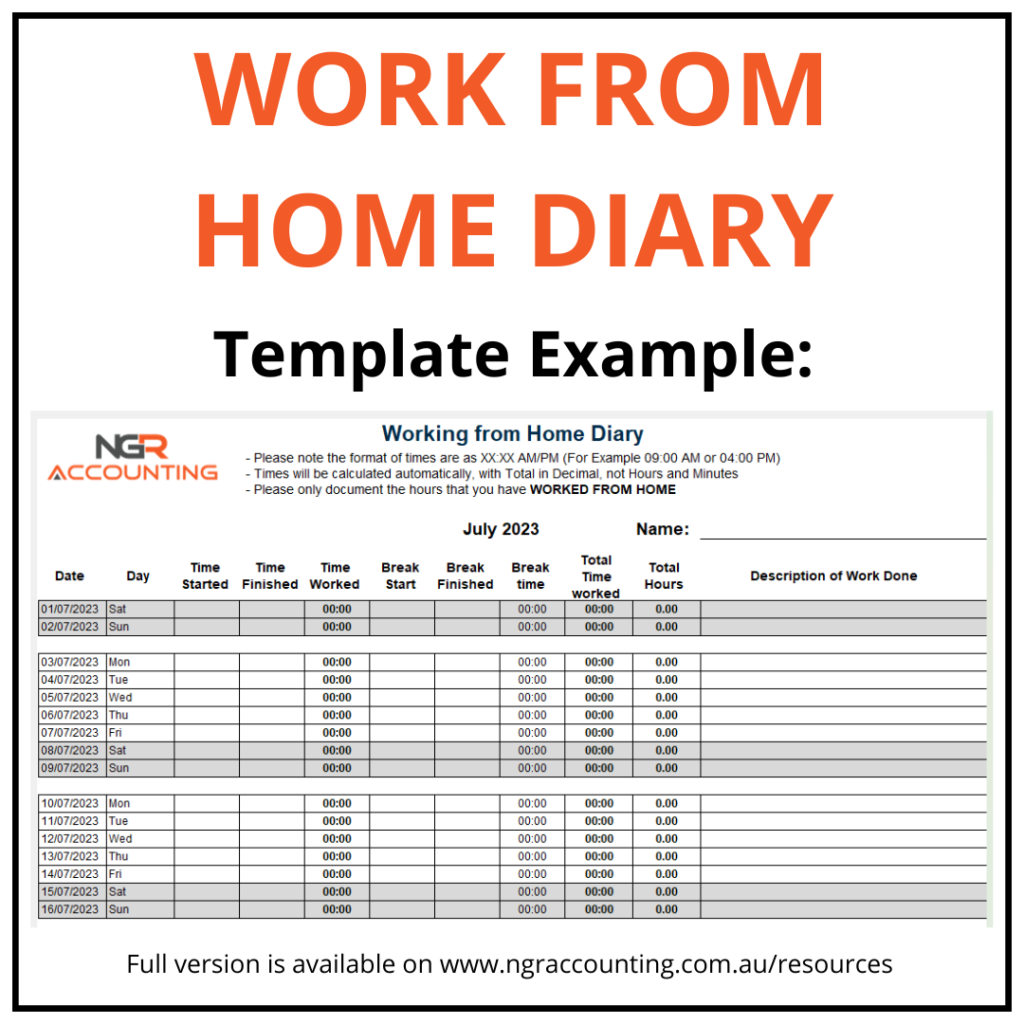

As part of the ATO’s effort to ensure accurate claiming and compliance, all individuals claiming work-from-home expenses are now required to complete a Work from Home Diary. This diary is crucial for both the Revised Fixed Rate Method and the Actual Cost Method.

The Work from Home Diary serves as a logbook where you record the number of hours you work from home. This record of hours worked is necessary for calculating your deductions accurately. Make sure to note the start and end times of your work-from-home sessions, as well as any breaks taken.  We understand that record-keeping can be challenging, so to help you stay organised, we have provided a user-friendly Work from Home Diary template on our website: https://www.ngraccounting.com.au/resources. You can easily download and print the template to start tracking your work-from-home hours effectively.

We understand that record-keeping can be challenging, so to help you stay organised, we have provided a user-friendly Work from Home Diary template on our website: https://www.ngraccounting.com.au/resources. You can easily download and print the template to start tracking your work-from-home hours effectively.

Resources from the ATO

The ATO provides valuable resources and tools to assist taxpayers with their work-from-home deductions:

Online Calculators: The ATO offers online calculators to help you work out the decline in value of assets and equipment purchased for your home office. This will aid you in determining the correct amount you can claim for depreciation.

myDeductions Tool: The ATO app features the myDeductions tool, which can be a handy way to keep track of your work-related expenses. You can use this tool to record your expenses as they occur, making it easier to compile your deductions at tax time.

We like to remind our clients that accurate record-keeping and documentation are essential to ensure you can claim the deductions you’re entitled to while complying with the ATO’s regulations.

As tax time approaches, we want to make the process as smooth as possible for you. Feel free to reach out to us for guidance and assistance with your work-from-home deductions. Our team is here to help you navigate through these changes and maximise your tax benefits.

Claiming work-from-home expenses doesn’t have to be complicated. With the right knowledge and tools, you can ensure you’re making the most of the deductions available to you. Let’s work together to achieve your financial goals while staying compliant with the ATO’s requirements.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated 22nd July, 2023

JM