Hello everyone, Sue, your Xero Hero, here to discuss Bookkeeping, and why it’s so important for your business.

There are a few questions I like to ask clients when looking into whether having an external bookkeeper. These are:

Hello everyone, Sue, your Xero Hero, here to discuss Bookkeeping, and why it’s so important for your business.

There are a few questions I like to ask clients when looking into whether having an external bookkeeper. These are:

- What are your current bookkeeping processes and who handles them in-house?

- Are you satisfied with the accuracy and timeliness of your financial records and reports?

- How much time are you or your employees currently spending on bookkeeping-related tasks?

- Have you experienced any challenges or issues related to bookkeeping, such as compliance errors or inaccuracies in financial records?

- Are you looking for additional support and guidance in financial management, tax planning, or strategic decision-making?

- Would you prefer to have more time and resources to focus on core business activities rather than bookkeeping?

- Are you open to exploring the services and expertise offered by professional external bookkeepers to enhance your financial processes?

What’s the difference between a Bookkeeper and an Accountant?

“Bookkeeping focuses on recording and organising financial data. Accounting is the interpretation and presentation of that data to business owners and investors.” – XeroAn accountant is a financial professional who provides a range of services related to financial analysis, reporting, taxation, and strategic planning. They typically hold professional qualifications, such as a bachelor’s degree in accounting or a related field and may also hold certifications such as Certified Practicing Accountant (CPA) or Chartered Accountant (CA). Responsibilities of an Accountant:

- Financial Reporting: Accountants prepare and analyse financial statements, such as profit and loss statements, balance sheets, and cash flow statements.

- Tax Compliance: Accountants assist individuals and businesses in fulfilling their tax obligations, including preparing and submitting tax returns, providing tax planning advice, and ensuring compliance with tax laws and regulations.

- Financial Analysis: Accountants analyse financial data, identify trends, and provide insights to support business decision-making and strategic planning.

- Auditing: Accountants may perform audits of financial statements to ensure accuracy, compliance, and adherence to accounting standards.

- Advisory Services: Accountants provide guidance on financial matters, including budgeting, forecasting, investment decisions, and risk management.

- Record-Keeping: Bookkeepers record financial transactions, including sales, purchases, receipts, and payments, in the appropriate accounting software or ledgers.

- Reconciliation: Bookkeepers reconcile bank statements, credit card statements, and other financial records to ensure accuracy and identify any discrepancies.

- Payroll Processing: Bookkeepers may handle payroll tasks, including calculating wages, managing superannuation contributions, and preparing payroll tax documents.

- BAS Preparation: Bookkeepers often assist with preparing and lodging Business Activity Statements (BAS) to report GST (Goods and Services Tax) obligations.

- Data Entry and Classification: Bookkeepers enter financial data into accounting systems, categorise expenses, and maintain organised records.

So… When do I need a bookkeeper?

In most cases, Business Owners take on the role of most administrative tasks within the business, including the day today bookkeeping of their business. The likelihood is that if you’re asking us that question, you probably already do, but here’s 5 signs I believe shows when you need a bookkeeper.1. You’re spending too much time doing your bookkeeping

Outsourcing administrative tasks is something all businesses look towards when they become time poor in their day-to-day workflow. It might not be feasible for you to have one dedicated employee in your office looking after your bookkeeping or administrative tasks. If you’re a small business, you might only need a bookkeeper an hour or two a week. If you are a larger business, maybe you need a few days to manage your bookkeeping. Having an outsourced bookkeeper means you’re hiring someone that specialises in maintaining the accounts for only the time that is required.2. You’ve taken on new or more employees

Employing staff means that you are required to meet standards from the ATO, Superannuation Funds and even Workers Compensation. Our bookkeeper can relieve you of this burden by providing a comprehensive, confidential payroll service that includes:- Customised payslips

- Administration of PAYG, statutory sick pay, annual leave, and long service leave calculations (if applicable).

- ATO filing

- Summaries and analysis of staffing costs

- Administration of incentive schemes, bonuses, and termination payments.

- low operating profits or cash flow from the business

- problems paying trade suppliers and other creditors on time

- trade suppliers refusing to extend your business further credit

- problems with meeting loan repayments on time or difficulty keeping within overdraft limits

- legal action taken, or threatened, by trade suppliers or other creditors over money owed to them.

3. You’re struggling with the compliance side of your accounts

Do you know what compliance requirements you need to keep track of? Do you understand your obligations with the Australian Tax Office, Superannuation Funds, or Workers Compensation? Have you kept all your records up to date, including your receipts? Our bookkeeper loves being kept up to date with all the compliance and regulatory information that you need to run your business. They can also make sure all your receipts are kept safe, and your accounts are maintained and balanced.4. It can save you money

Having a bookkeeper looking over all your day-to-day finances means that you have someone experienced looking out for any costly mistakes or inaccuracies and correct them quickly and efficiently for you. In the long run, having a qualified eye reviewing your accounts makes sure that you are making the right decisions based on your immediate needs.5. Are you losing track of invoices and bills?

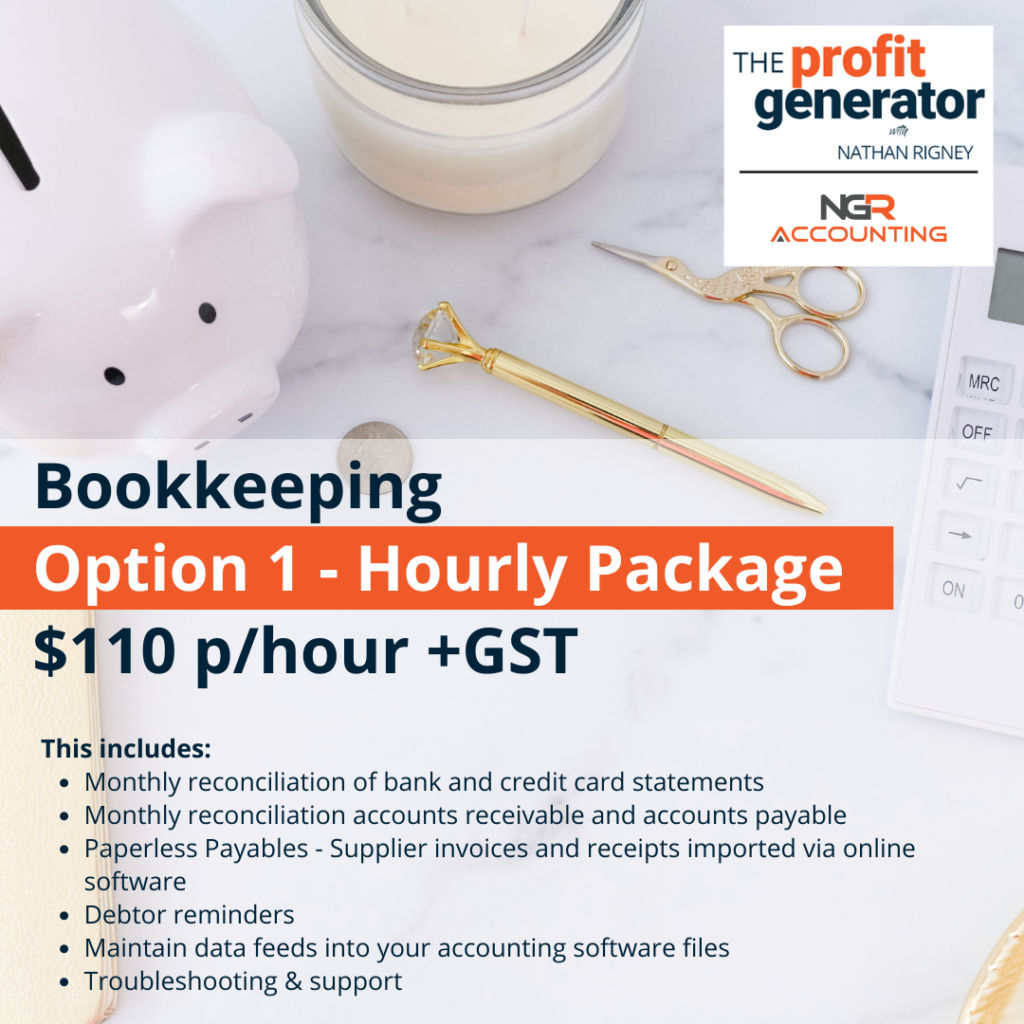

Bookkeepers can keep a track of your outstanding jobs and the invoicing for them, when required. A bookkeeper can also follow up outstanding invoices with your clients, freeing up time that you spend chasing up payments. A bookkeeper can also keep on top of your creditors, making sure who you owe money to, and when these are due. Inputting the bills that you owe allows you to see a true representation of your profit as well as a great opportunity to manage your cash flow.At NGR Accounting, we are happy to review your circumstances, and determine if we should be looking after your bookkeeping needs. We have 4 different packages for your bookkeeping services, and they are:

Are you ready to find more hours in your day?

Connect with NGR Accounting to have a quality conversation in relation to what package would suit you and your business, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.auFULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances. Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided. Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites. By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer. Updated Wednesday 19th July, 2023JM