Hello, Sue here, your Xero Hero.

I wanted to share with you one easy thing you can do to help you with your Xero File, and that’s give NGR Accounting (or your bookkeeper) access to view it.

Your Online Accounting Software is one of the most useful tools available to businesses. Not only does it let you have access to your accounts from anywhere in the world, but it means you can collaborate with others remotely.

This collaboration speeds up your accounting and bookkeeping work. This means that:

- Your bookkeeper and/or the team at NGR Accounting can review your file at any time, allowing us to confirm that your books are balanced.

- It gives us the opportunity to make sure you’re meeting all your compliance needs, from ATO reporting, BAS reconciliation and even Super Guarantee payments are being made on time.

- It reduces your travel time, by allowing us to review your file, without you even leaving your office.

- Improving efficiency within your business if you have an internal bookkeeper or office clerk, where you (the business owner) will be able to overview, every entry reconciled.

So, the next question is:

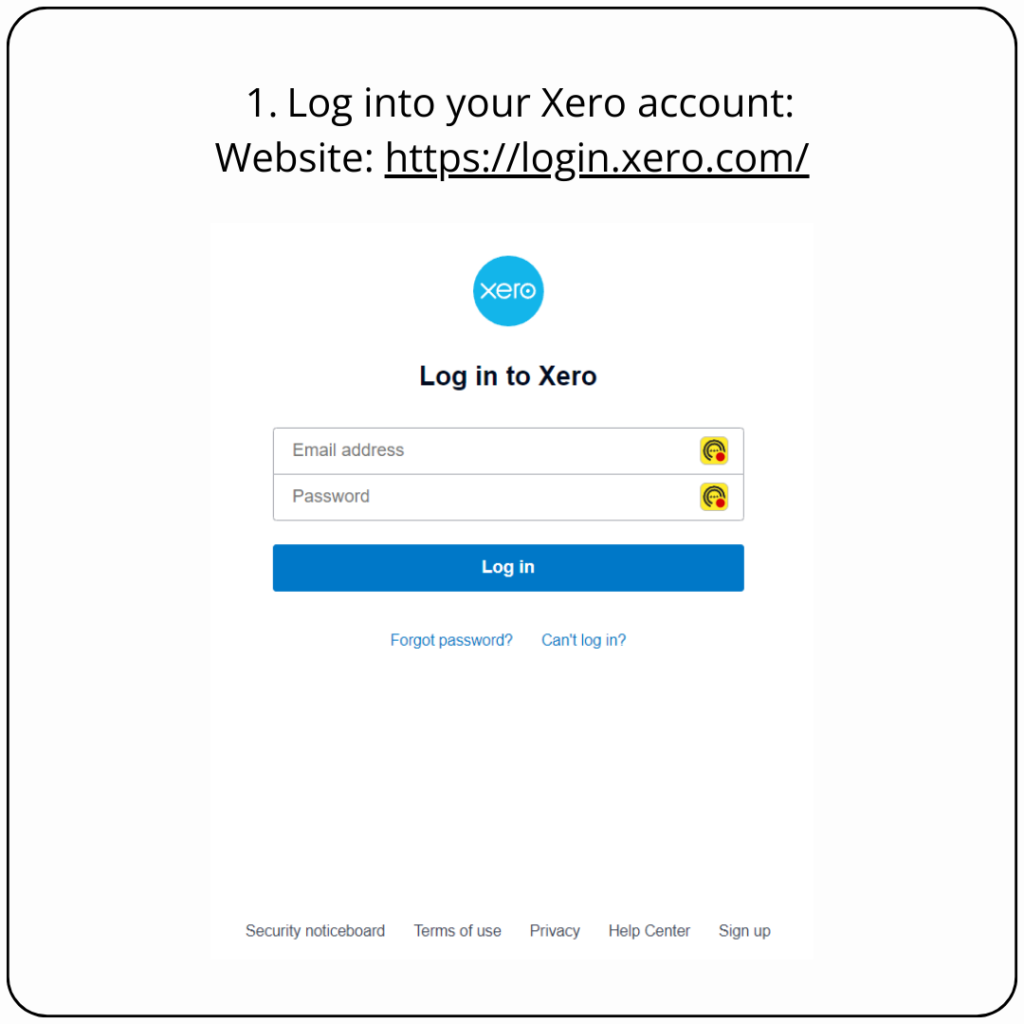

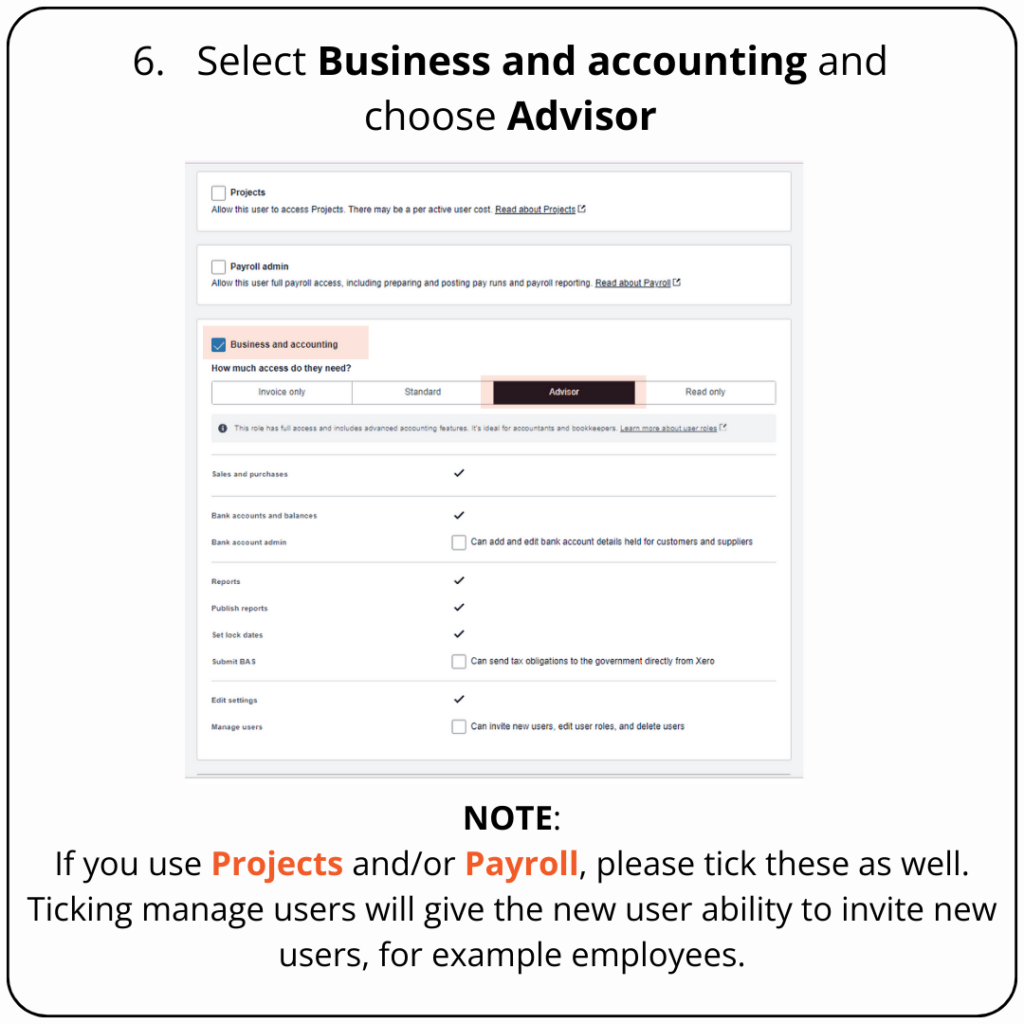

How do I give my accountant access to Xero?

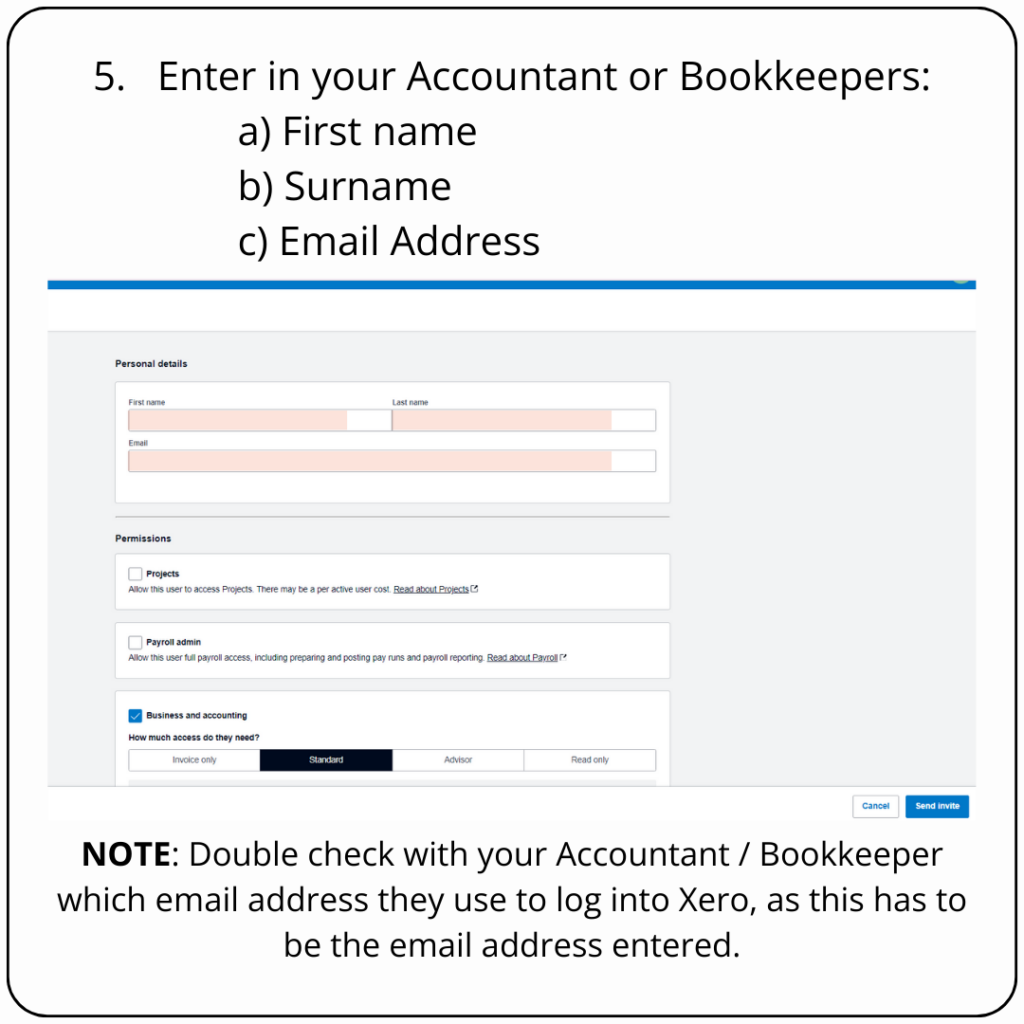

After you have completed all the above steps, your accountant or bookkeeper will receive an email with the invitation link. They will need to accept the invitation so that they can access your Xero. This access is provided immediately.

Note: This invitation is only valid for 14 days. If your accountant or bookkeeper does not accept the invitation within this timeframe, you can resend the request by following these steps:

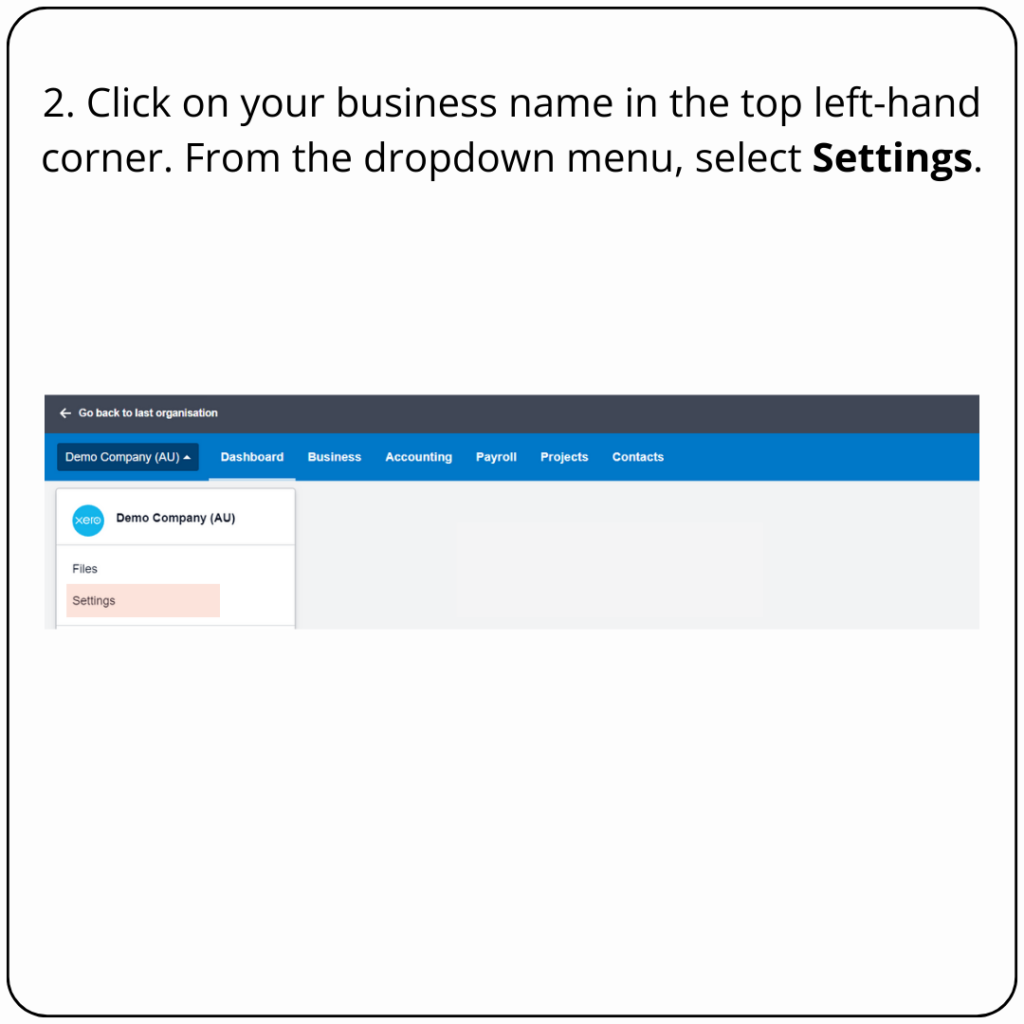

- Click on the organisation name and select Settings.

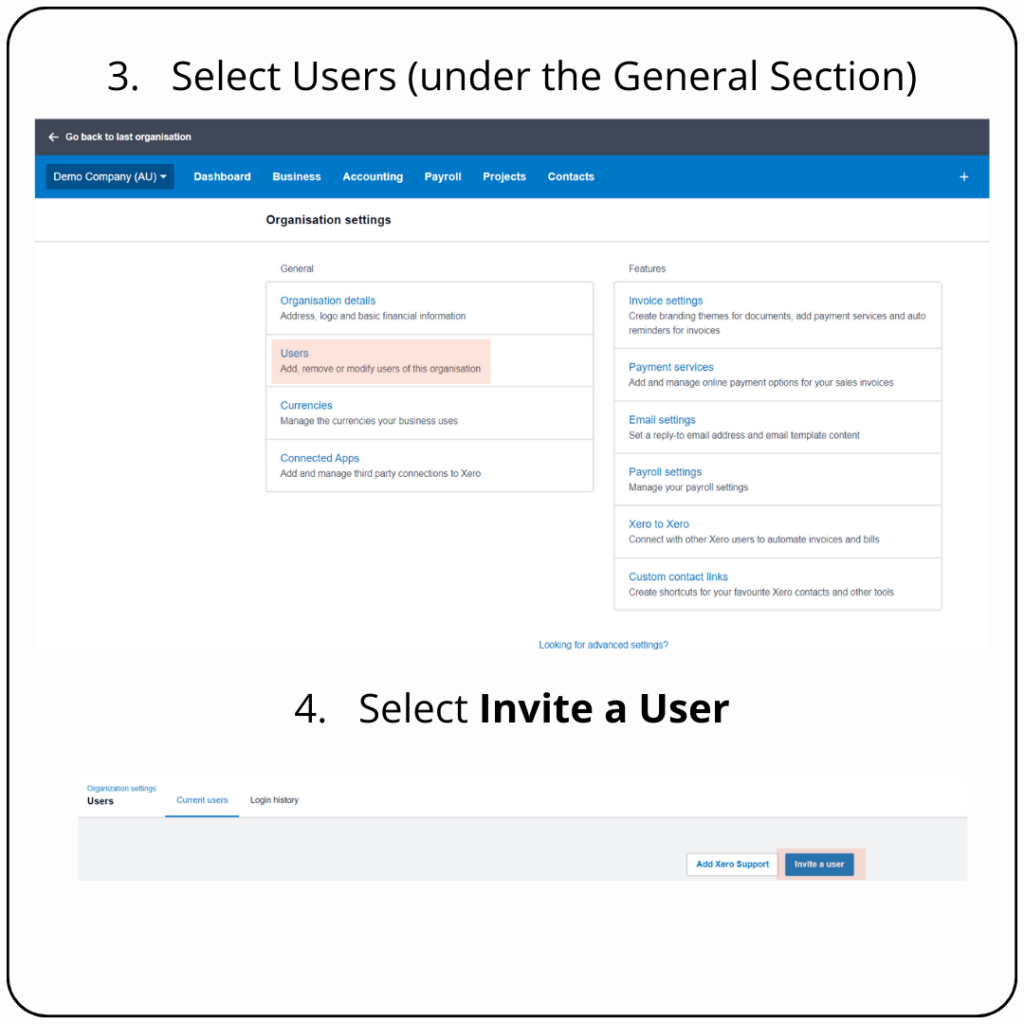

- Click on Users.

- Click on the name of the pending user.

- Click Resend

- Optionally, you can add a message or use the default text.

- Click Send invite.

Next Steps:

If you have any issues setting this up, want to confirm what email address to use, or any other questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

If you ever need a quick refresher on how this is done, we will also be adding this guide in our Resources page on our website.

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Dated: 12th February, 2024

JM