Hey guys, Nathan here.

As an accountant, I can understand that lodging your Fringe Benefits Tax (FBT) can be a daunting task for many of my clients.

I want to outline the key responsibilities that clients need to be aware of, import dates to keep in mind, and… where to find more information. So, let’s go.

What is FBT?

FBT is a tax paid by employers on certain benefits provided to their employees or their associates, in addition to their salary or wages. Examples of what fringe benefits could include are company cars, gym memberships, and private health insurance.

To determine whether an employer needs to pay FBT, the must calculate the taxable value of the fringe benefits provided to their employees.

What are your key responsibilities?

As a client, it is your responsibility to:

1. Keep Accurate Records

You must keep records of all fringe benefits provided to employees, including the date the benefit was provided, the type of benefit, and the value of the benefit. This information will be used to calculate the taxable value of the fringe benefits.

2. Lodge an FBT Return

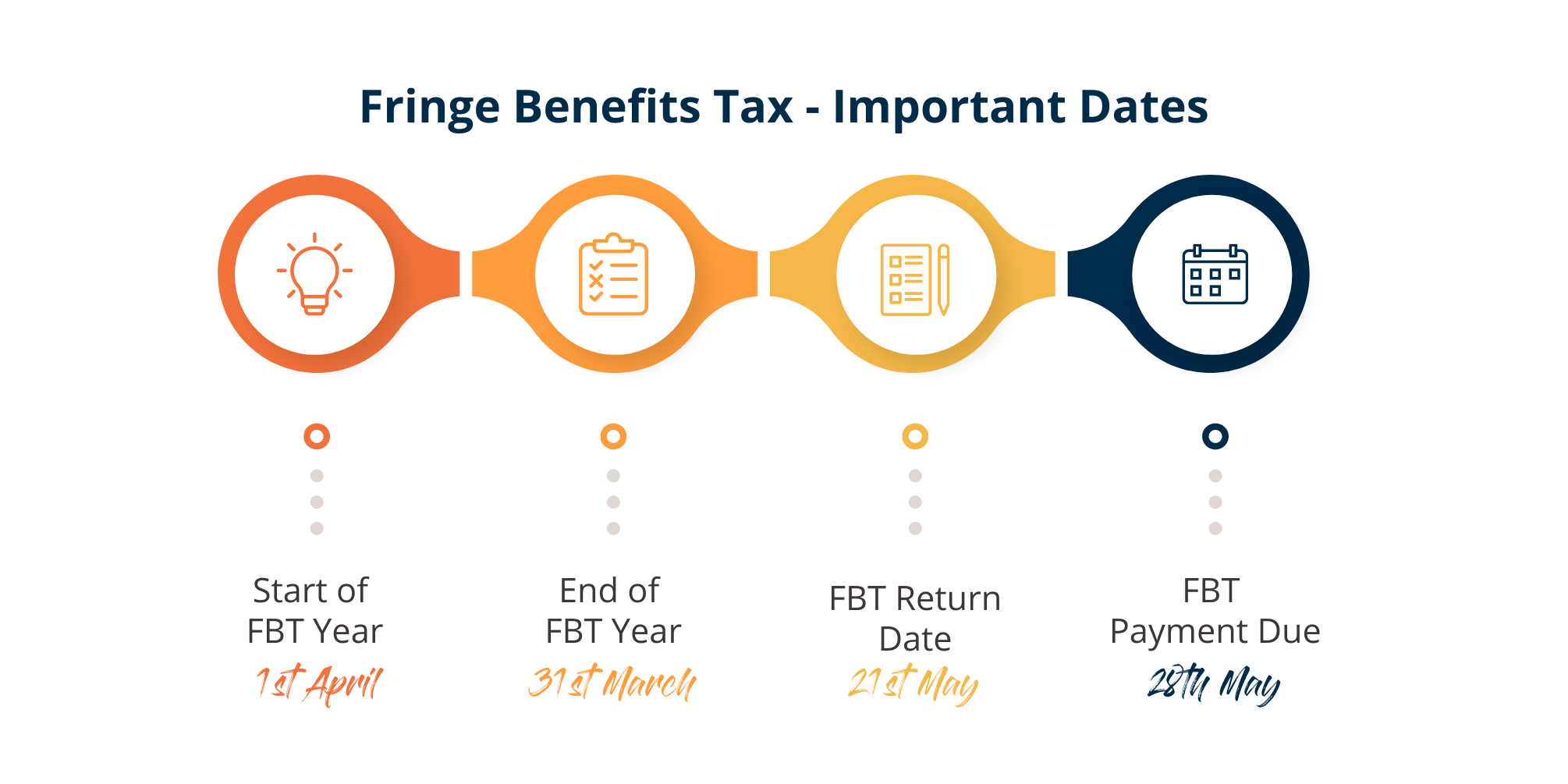

If you have provided fringe benefits to your employees during the FBT year (1st April to 31st March), you are required to lodge an FBT return by 21st May each year. This return must include details of all fringe benefits provided to employees, as well as any FBT payable.

3. Pay any FBT owed

If you have a liability for FBT, you must pay it by 28th May each year. If you are unable to pay the fill amount by this date, you may be able to enter into a payment arrangement with the Australian Taxation Office (ATO).

What key dates you should be aware of?

Where can you find more information?

Of course, if you think that your business may be required to record, lodge, and pay FBT then having a quality conversation with the team at NGR Accounting is always a great start.

However, the ATO website also is a great resource in relation to FBT. They have a range of resources available, including guides, fact sheets and videos to help you understand your obligations as an employer when it comes to FBT.

As long as you understand your key responsibilities, the important dates and where to find more information, you can feel more confident in your FBT lodgement.

I’m Nathan Rigney, the Profit Generator.

If you would like more information, or to book an appointment with me to discuss your business and personal financial planning goals and how to achieve them, feel free to contact us on 02 9011 6669 or email us at info@ngraccounting.com.au

Updated 28th March, 2023

JM