Category: Small Business Tips

-

Profit First got me HERE!

In the latest episode of The Profit Generator Show, Nathan reflects on his family holiday to Thailand and dives into the powerful lessons learned both abroad and in business. Drawing on his 25 years of experience as an accountant, Nathan shares the patterns of financial crisis he’s seen in small businesses and how implementing the…

-

Profit FIRST not Profit LAST

In the latest episode of The Profit Generator podcast, Nathan Rigney, founder of NGR Accounting, sheds light on why traditional accounting models often fall short for business owners and introduces a new approach with the Profit First system. Nathan dives into how a simple mindset shift—prioritizing profit over expenses—can break the cycle of financial struggle…

-

What is your accountant NOT doing for YOU?

In today’s post, we dive into why traditional accountants are falling short of what businesses truly need. Nathan Rigney, known as the Profit Generator, breaks down the flaws of focusing only on compliance and tax returns. He makes a compelling case for working with an accountant who does more—someone who provides proactive advice, tailored growth…

-

Does your Accountant and Bookkeeper have access to your Xero?

Hello, Sue here, your Xero Hero. I wanted to share with you one easy thing you can do to help you with your Xero File, and that’s give NGR Accounting (or your bookkeeper) access to view it. Your Online Accounting Software is one of the most useful tools available to businesses. Not only does it…

-

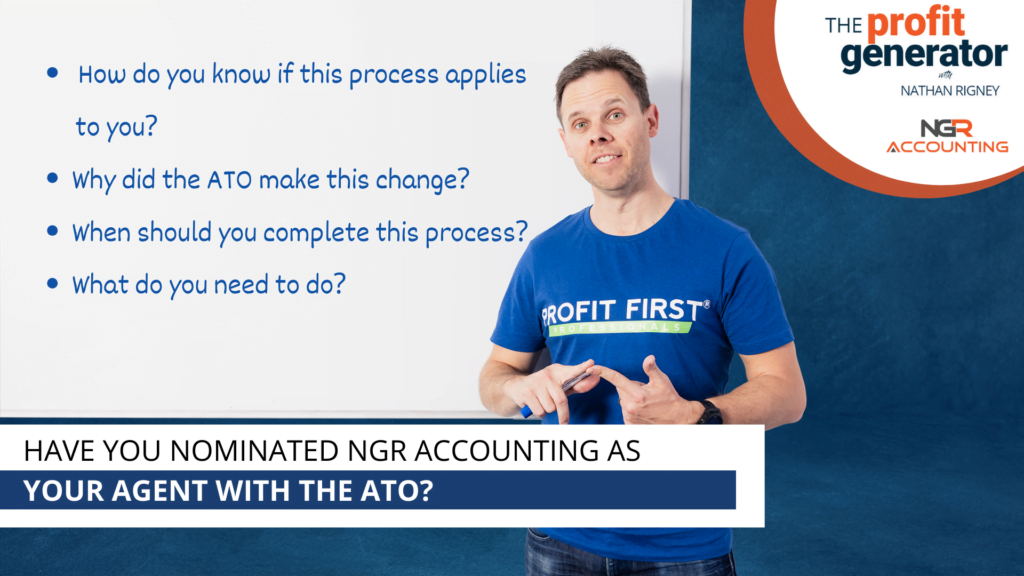

Have you nominated NGR Accounting as your Agent with the ATO?

Hey guys, Nathan here. I want to take some time to guide you through an update from the Australian Taxation Office (ATO) that could impact your business – the Agent Nomination Process. So, Let’s Go! 1. What is nominating NGR Accounting as your Agent all about: The agent nomination process is a new requirement…

-

Setting SMART Financial Goals for Your Business in the New Year

As we step into the new year, it’s the perfect time to set the stage for financial success. In our journey toward achieving business excellence, we’ve previously explored the importance of short term and long term strategic planning (https://ngraccounting.com.au/are-you-planning-short-term-or-for-the-long-term/) and the SMART criteria for goal-setting (https://ngraccounting.com.au/smart_planning/). Today, I’d like to delve deeper into your financial…

-

Festive Financial Hangovers

Hey guys, Nathan here. It’s coming up to the Festive time of year, of course for most it starts from the Melbourne Cup, and before you know it you’ve been to four, five, sometimes 9-10 Christmas Parties. And for a lot of us, Christmas and New Year is an exciting time of the year, not…

-

Unlocking Business Growth and Profit Potential Through Self-Improvement and Training

Hey guys, Nathan here. Let’s discuss how self-improvement, training, and coaching can turbocharge your business for bigger profits and growth. In today’s fast-changing business world, staying ahead is a must. We will look at where to get this crucial know-how and how it can supercharge your business and your profits. Where to go for your…

-

Unlocking Success: The Power of Peer Groups in Business Growth

I want to dive into the world of Peer Groups and how they can bring significant benefits to your business. Networking is crucial, but building a Peer Group takes it a step further by fostering deep connections with like-minded individuals who can provide valuable insights and support. In this blog, I want to explore the…

-

Mental Health Month: Financial Goal Setting for a Positive Mindset

Hey guys, Nathan here, The Profit Generator. This month is all about Mental Health Awareness, and today, I want to talk about something that can truly transform your life: financial goal setting and its profound impact on your mental wellbeing. In a world where financial stress is all too common, taking control of your financial…

-

Unlocking Success: The Power of Networking for Your Business

Hey guys, Nathan here. I wanted to chat to you about Networking for your business, and its benefits. So, let’s go! In today’s business world, networking has become an indispensable tool for fostering growth and success. It’s not just about exchanging business cards and shaking hands; it’s about building valuable relationships that can propel your…

-

Dealing with Business Fraud: Your Action Plan When Suspicions Arise

Hey guys, Nathan here. Fraud in business is a serious matter that no one wants to face, but unfortunately, it can happen to even the most well-managed companies. As a business owner, it’s essential to know what steps to take if you ever suspect or realise that fraud is occurring within your organisation. In this…