Claiming Work from Home Expenses on Your 2022/2023 Income Tax Return

Have you considered the new ATO requirements for recording your Work from Home hours?

Did you know that there has been changes to the rates for Working from Home deductions?

Hey guys, Nathan here, and as we start to get some enquiries to complete our client’s 2022/2023 Income Tax Returns, I thought I would revisit these changes.

As we all know, the way we work has drastically changed over the past couple of years. The COVID-19 pandemic has accelerated the adoption of remote work, and many of us have found ourselves working from home more frequently.

If you’ve been working from home during the 2022/2023 financial year, you may be eligible to claim deductions for your work-related expenses. However, it’s important to be aware of the recent changes announced by the Australian Taxation Office (ATO) in March 2023. Let’s dive into the details:

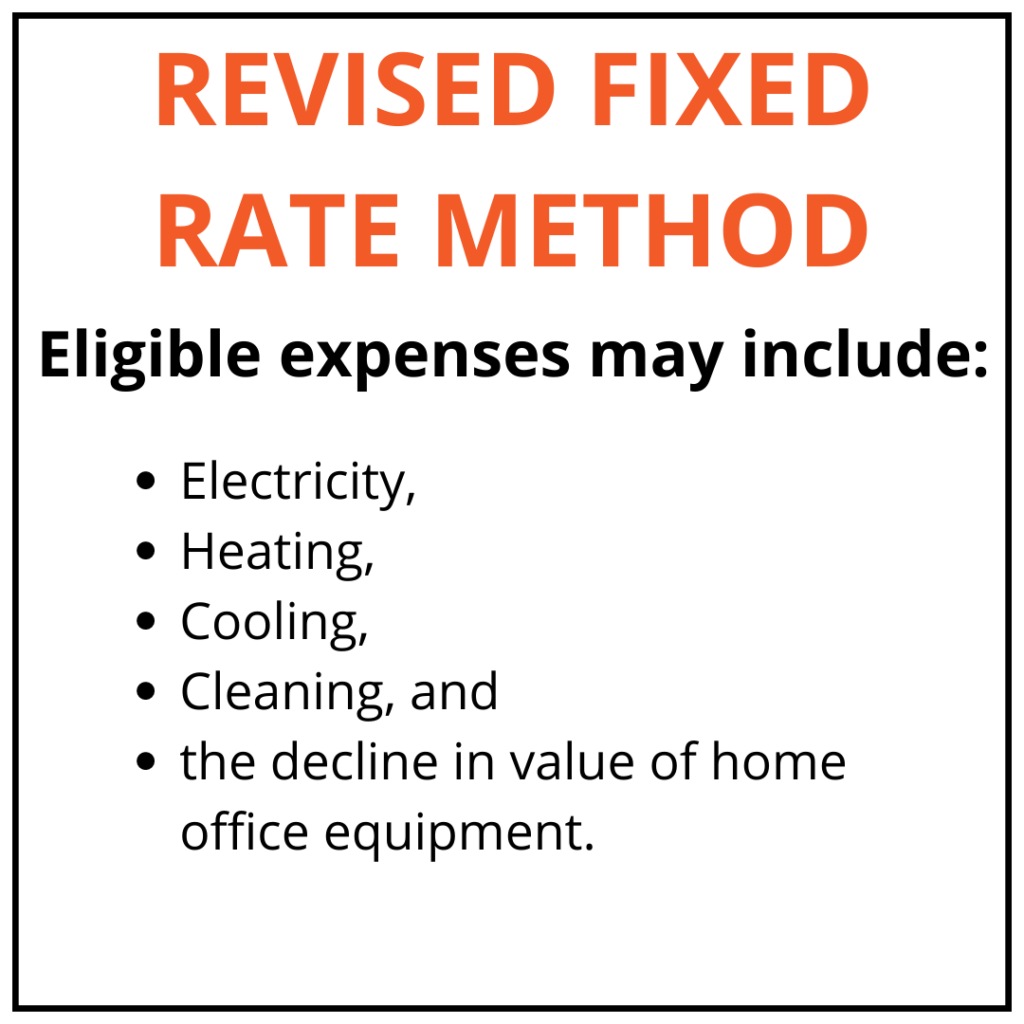

Revised Fixed Rate Method

Starting from March 2023, the ATO has introduced the Revised Fixed Rate Method, which simplifies the process of claiming deductions for work-from-home expenses. Under this method, you can claim 67 cents per hour for every hour you work from home.  By using this method, you no longer need to calculate specific expenses individually, making it much more straightforward to claim your deductions. However, you will need to maintain a diary of these hours that you do work from home. See below Changes to Record Keeping.

By using this method, you no longer need to calculate specific expenses individually, making it much more straightforward to claim your deductions. However, you will need to maintain a diary of these hours that you do work from home. See below Changes to Record Keeping.

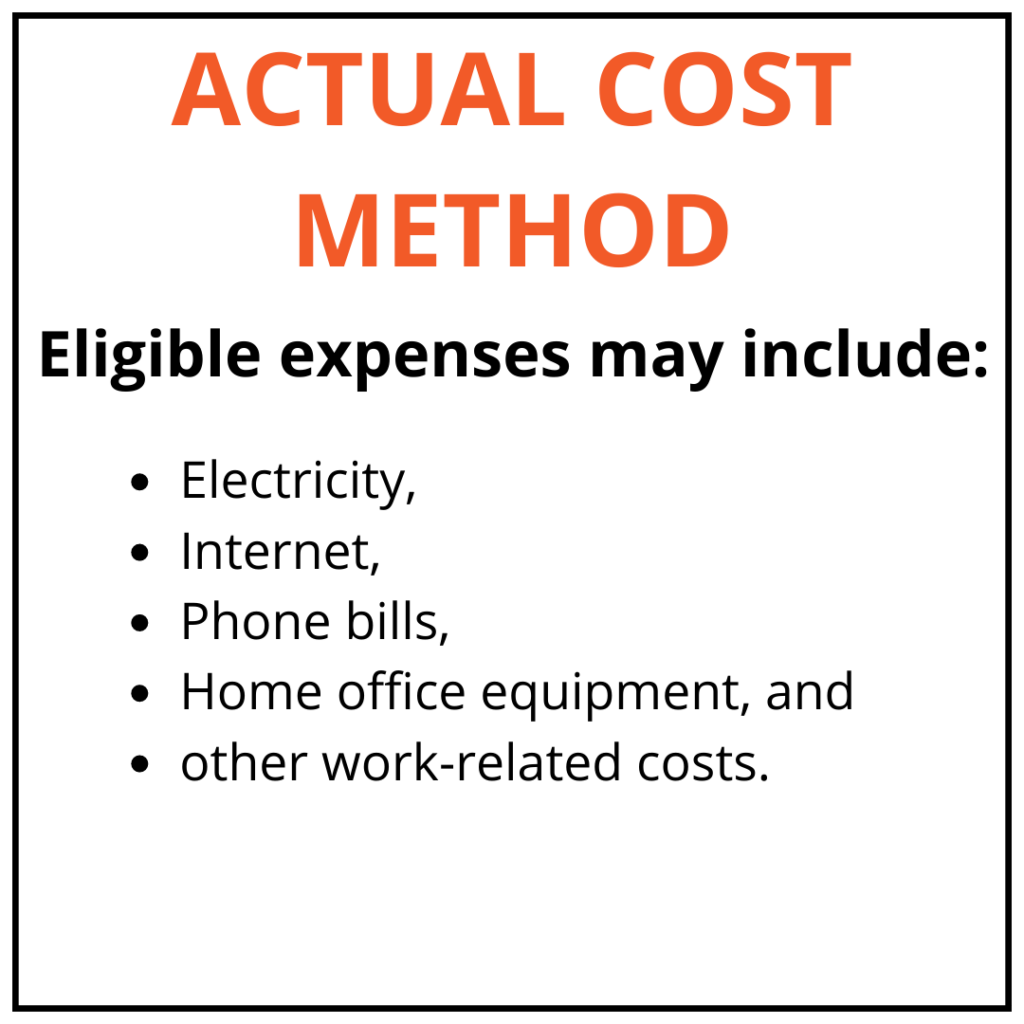

Actual Cost Method – Claiming Your Specific Expenses

If you prefer to claim your actual expenses rather than using the fixed rate method, you can still opt for the Actual Cost Method. This method allows you to claim deductions for the actual expenses you incur because of working from home.  To claim using the Actual Cost Method, it’s essential to keep accurate records of your expenses throughout the year. This can be achieved through receipts, invoices, or other documentation that clearly shows the costs you’ve incurred. While this method requires more record-keeping, it may result in higher deductions if you have substantial work-related expenses.

To claim using the Actual Cost Method, it’s essential to keep accurate records of your expenses throughout the year. This can be achieved through receipts, invoices, or other documentation that clearly shows the costs you’ve incurred. While this method requires more record-keeping, it may result in higher deductions if you have substantial work-related expenses.

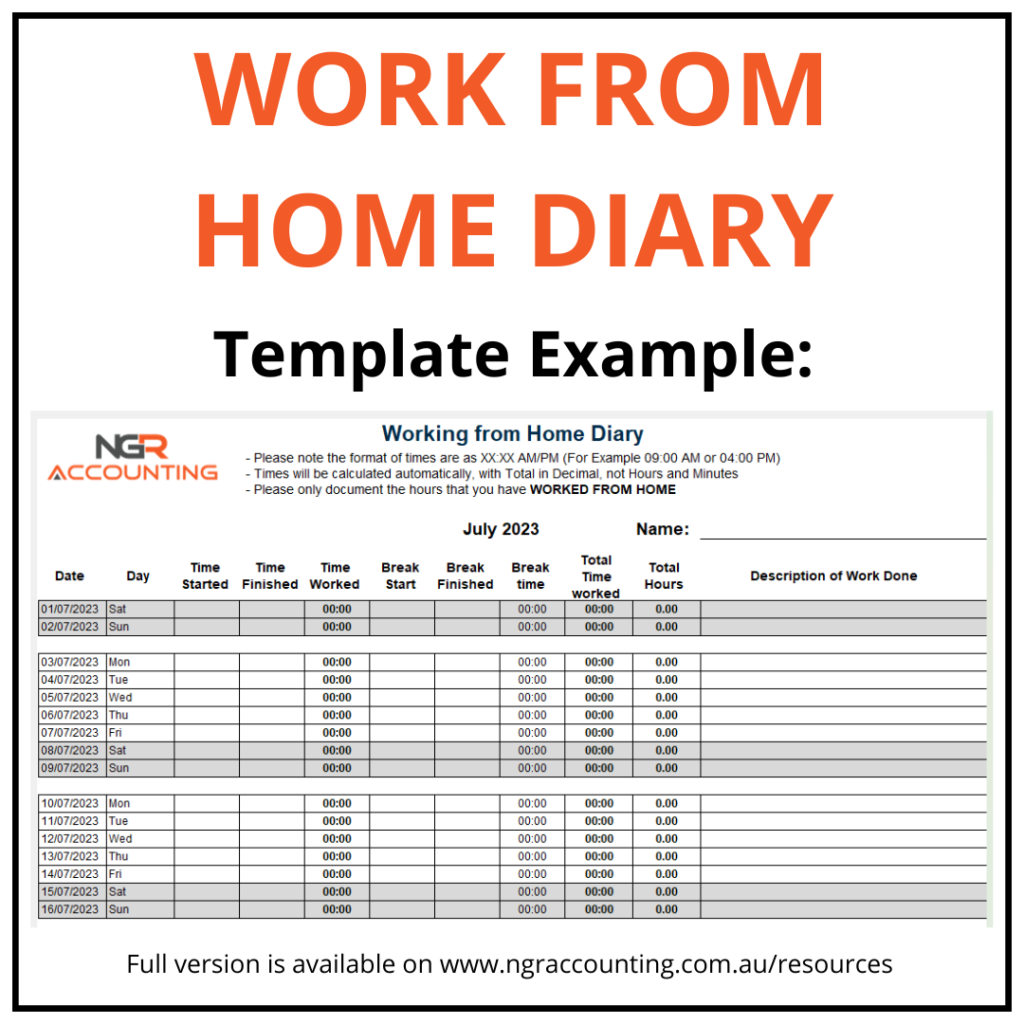

Changes to Record Keeping

As part of the ATO’s effort to ensure accurate claiming and compliance, all individuals claiming work-from-home expenses are now required to complete a Work from Home Diary. This diary is crucial for both the Revised Fixed Rate Method and the Actual Cost Method.

The Work from Home Diary serves as a logbook where you record the number of hours you work from home. This record of hours worked is necessary for calculating your deductions accurately. Make sure to note the start and end times of your work-from-home sessions, as well as any breaks taken.  We understand that record-keeping can be challenging, so to help you stay organised, we have provided a user-friendly Work from Home Diary template on our website: https://www.ngraccounting.com.au/resources. You can easily download and print the template to start tracking your work-from-home hours effectively.

We understand that record-keeping can be challenging, so to help you stay organised, we have provided a user-friendly Work from Home Diary template on our website: https://www.ngraccounting.com.au/resources. You can easily download and print the template to start tracking your work-from-home hours effectively.

Resources from the ATO

The ATO provides valuable resources and tools to assist taxpayers with their work-from-home deductions:

Online Calculators: The ATO offers online calculators to help you work out the decline in value of assets and equipment purchased for your home office. This will aid you in determining the correct amount you can claim for depreciation.

myDeductions Tool: The ATO app features the myDeductions tool, which can be a handy way to keep track of your work-related expenses. You can use this tool to record your expenses as they occur, making it easier to compile your deductions at tax time.

We like to remind our clients that accurate record-keeping and documentation are essential to ensure you can claim the deductions you’re entitled to while complying with the ATO’s regulations.

As tax time approaches, we want to make the process as smooth as possible for you. Feel free to reach out to us for guidance and assistance with your work-from-home deductions. Our team is here to help you navigate through these changes and maximise your tax benefits.

Claiming work-from-home expenses doesn’t have to be complicated. With the right knowledge and tools, you can ensure you’re making the most of the deductions available to you. Let’s work together to achieve your financial goals while staying compliant with the ATO’s requirements.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated 22nd July, 2023

JM

5 Reasons to Consult your Accountant before Changing from Sole Trader to a Company

Here are 5 reasons to talk with your accountant before considering the change.

In the world of small to medium-sized businesses in Australia, there often comes a point where the decision to transition from being a sole trader to establishing a company structure needs to be considered.

Hey, Kathryn here. I wanted to discuss one of the biggest business decisions that you might make as a business owner. However, before making any changes it is crucial to consult with us, your accountant.

We can provide valuable insights and guidance to ensure you make an informed choice that aligns with your business goals and financial situation. In this blog post, I will explore the difference between a sole trader and a company and present 5 reasons why discussing this change with your accountant is essential.

Sole Trader vs. Company

Before delving into the reasons for consulting your accountant, it’s important to understand the fundamental difference between a sole trader and a company.

Sole Trader: A sole trader is an individual who operates a business on their own, you are still required to register for an Australian Business Number (ABN). As a sole trader, you are personally liable for the debts and obligations of the business. The profits and losses generated by the business are considered personal income or deductions on your individual tax return.

Company: A company, on the other hand, is a separate legal entity from its owners, known as shareholders. A company requires formal registration with the Australian Securities and Investments Commission (ASIC).

The liability of those who own shares is limited to their shareholding unless they also act as a Director and have acted illegally or continued trading while the company is insolvent.

The company’s profits and losses are taxed separately from the individual shareholders.

Now that we have established the difference between a sole trader and a company, let’s explore why discussing this change with your accountant is crucial.

1. Legal and Compliance Requirements

Establishing a company involves various legal and compliance obligations that differ from those of a sole trader. We can guide you through these requirements and help you understand the implications and responsibilities associated with operating as a company. We can provide information about the necessary registrations, permits, and licenses, ensuring that you comply with all relevant laws and regulations.

2. Tax Implications

Transitioning from a sole trader to a company can have significant tax implications. We can assess your current tax situation and determine whether incorporating as a company would be beneficial from a tax perspective. We can explain the tax implications, such as changes in your reporting obligations, deductions, and tax rates. Additionally, we can advise you on the most tax-efficient structure for your business and help you navigate any potential pitfalls.

3. Asset Protection and Risk Management

Operating as a company offers certain advantages in terms of asset protection and risk management.

By separating your personal assets from your business liabilities, you can mitigate the risks associated with business activities. NGR Accounting can assess your business’s risk profile and advise you on the potential benefits of incorporating in terms of asset protection. We can help you understand the legal ramifications and liabilities associated with your business structure and recommend strategies to safeguard your personal assets.

4. Access to Capital and Funding Opportunities

Incorporating your business can open opportunities for accessing capital and securing funding. NGR Accounting can help you explore different funding options available to companies, such as bank loans, venture capital, or issuing shares. We can guide you through the process of preparing financial statements and business plans that meet the requirements of potential investors or lenders. Additionally, we can assist you in assessing the financial viability of your business and determining the most appropriate funding sources.

5. Long-Term Business Strategy

Transitioning from a sole trader to a company is a significant decision that should align with your long-term business strategy.

(If you want more information about Business Planning, check out our previous Blog, Are you Planning for the Short Term or the Long Term?)

At NGR Accounting, we can review your business goals, financial projections, and growth plans to determine if incorporating is the right move for you. We can provide valuable insights into the pros and cons of each business structure and help you evaluate the impact on your future. By considering your unique circumstances, we can offer strategic advice that supports your business’s overall objectives.

The decision to change from a sole trader to a company is an important one for small to medium-sized businesses. It is crucial to consult with the team at NGR Accounting before making any changes to ensure that you understand the implications and benefits associated with the transition.

NGR Accounting can provide guidance on:

- legal and compliance requirements,

- tax implications,

- asset protection,

- access to capital and funding opportunities, and

- long-term business strategy.

I would recommend having some questions to discuss your options with your accountant, and the top 11 questions are:

By seeking professional advice, you can make an informed decision that aligns with your business goals and maximises your chances of success. NGR Accounting is a trusted partner who can provide the expertise and support you need throughout this process.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness, or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated: 13th July

JM

Starting a New Employee?

6 Compelling Reasons to Consult Your Accountant before Starting a New Employee

Hello everyone, it’s Sue. I thought it might be a great idea at this time of year, to discuss putting on a new employee, and in this blog post, I thought I would highlight 6 reasons why contacting NGR Accounting before employing a new staff member is highly recommended.

ATO Compliance:

The ATO has specific regulations and requirements that employers must adhere to when hiring new employees. We are well-versed in these obligations and can ensure that you meet all ATO compliance requirements. From obtaining Tax File Numbers (TFNs) to registering for Pay-As-You-Go (PAYG) withholding, we can guide you through the necessary steps to avoid any penalties or legal issues.

Employment Structure and Tax Implications:

Employment structures can significantly impact your tax obligations. Consulting with NGR Accounting before hiring a new employee will allow you to determine the most suitable employment arrangement for your business, such as full-time, part-time, or casual.

We will provide insights into the associated tax implications, including payroll tax, superannuation contributions, and fringe benefits tax (FBT), helping you make informed decisions that align with your financial goals.

Financial Impact Assessment:

Adding a new employee to your workforce entails financial considerations beyond the employee’s salary or wages. NGR Accounting can conduct a comprehensive financial impact assessment, considering factors such as recruitment costs, payroll taxes, superannuation contributions, and workers’ compensation.

This assessment will provide you with a clear understanding of the financial implications associated with hiring a new employee, helping you plan and budget effectively.

Award Interpretation and Payroll Setup:

Navigating the complex landscape of employment awards can be challenging for business owners. NGR Accounting can assist in interpreting relevant industry awards and determining the correct rates of pay, allowances, and entitlements for your new employee. Additionally, we can guide you in setting up your payroll system accurately, ensuring compliance with award conditions and avoiding potential underpayment issues.

Employment Contracts and Policies:

Creating appropriate employment contracts and policies is essential for establishing clear expectations and protecting your business’s interests. NGR Accounting can review and provide guidance on drafting employment contracts and developing workplace policies that align with legal requirements and industry standards. This will help you mitigate risks and maintain a harmonious work environment. We can also recommend the right specialist, if required, to make sure you and your employee are covered.

Tax Incentives and Grants:

NGR Accounting can also inform you about any available tax incentives or grants related to employing new staff members. We can help you identify and leverage government programs designed to support businesses in hiring and training employees. By taking advantage of these opportunities, you can potentially reduce your overall recruitment costs and receive financial support during the onboarding process.

Engaging the expertise of the team at NGR Accounting before employing a new team member is crucial for a smooth and compliant onboarding experience.

Our knowledge of ATO requirements, tax implications, financial assessments, and employment regulations will help you make informed decisions and avoid costly mistakes. By proactively involving us, you can focus on building a successful team and nurturing your business while ensuring adherence to ATO regulations and maintaining financial stability.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not consider your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated 21st June, 2023

JM

When should I talk to my accountant? When you’re Buying Big

Hey guys, Nathan here… I thought I would take some time to discuss Capital Expenditure.

As a business owner, I know that making decisions on capital expenses can be challenging.

It is essential to consider these expenses carefully as they can have a significant impact on your business’s financial health. This is why it’s important to speak to an accountant before making any Capex purchases.

In this blog, we’ll go over ten reasons why you should speak to an accountant before making any Capex purchases for your business.

Tax Implications

Making Capex purchases can affect your business’s tax obligations. We can advise you on the tax implications of Capex purchases, including depreciation and how to claim them on your taxes.

Cash Flow Management

We can help you manage your cash flow (check out our blog on Cash Flow Forecasting) and determine the best way to finance Capex purchases. We can advise you on different financing options and help you decide which one is the best for your business.

Financial Analysis

Before making any Capex purchases, it’s important to conduct a financial analysis to determine the impact on your business’s finances. We can provide you with that financial analysis and projections to help you make informed decisions.

Budgeting

We can help you create a Capex budget and determine the appropriate amount to allocate to these purchases.

Opportunity Cost

Capex purchases involve opportunity costs, which are the benefits you give up by choosing one option over another. We can help you evaluate the opportunity cost of Capex purchases and determine if they are worth the investment.

Return on Investment (ROI)

An accountant can help you calculate the ROI of Capex purchases, which is the measure of the return on your investment. This can help you determine if the investment is worth it.

Business Valuation

Capex purchases can affect your business’s valuation. We can advise you on how Capex purchases can impact your business’s value and help you make informed decisions.

Compliance

Capex purchases can be subject to different compliance requirements. We can advise you on compliance requirements and ensure that you are meeting all necessary regulations.

Risk Assessment

Capex purchases can involve risks, such as the risk of equipment failure or technological obsolescence. We can help you assess these risks and determine the best way to mitigate them.

Strategic Planning

Capex purchases can have a significant impact on your business’s strategic planning. We can help you align your Capex purchases with your business’s long-term goals and objectives. (If you need help working out your strategic plans, please check out our Blogs on Planning!)

Taking time to have a genuine conversation with myself and my team before making Capex purchases can help you make the informed decisions that will benefit your business in the long run.

We can provide you with valuable advice and guidance on:

- Tax implications,

- Cash flow management,

- Financial analysis,

- Budgeting,

- Opportunity cost,

- Roi,

- Business valuation,

- Compliance,

- Risk assessment, and

- Strategic planning.

I absolutely recommend that before you make any Capex purchases, please take some time to reach out and talk to myself and the team at NGR Accounting.

It could be the best investment you can make for your business’s financial health and success. Further reading, I would also check out our last blog: What is PPSR? And Why is it Good for My Business

If you would like to discuss this further, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not take into account your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness, or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated: 17th May 2023

JM

What is PPSR? And Why is it Good for My Business

So why is PPSR good for your business?

Security for your assets

Reduction of credit risk

By registering on the PPSR, your business can also reduce their credit risk. This is because creditors are more likely to extend credit to a business that has secured their assets. This increased security can also result in lower interest rates for credit, which can save businesses money in the long run.

Easy registration process

The registration process for PPSR is simple and can be completed online. This means that businesses can register their security interests without having to spend a lot of time or resources. Also, the cost of registration is low, making it an affordable option for businesses of all sizes.

Increased transparency

The PPSR also promotes transparency in business dealings. By registering on the register, businesses can view the security interests of other parties, providing greater transparency around the financial health of potential customers or partners.

Compliance with regulations

- protect their assets,

- reduce credit risk, and

- increase transparency in business dealings.

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not take into account your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated 9th May 2023

JM

Superannuation Guarantee Payments – What you need to know!

Hey everyone, Kathryn here.

I wanted to highlight the importance of making your Superannuation Guarantee payments on time, and even more importantly, in advance of their due date.

The Superannuation Guarantee Charge (SGC) can be a costly penalty imposed by the Australian Taxation Office (ATO) on employers who fail to meet their superannuation obligations. That’s why it’s crucial to understand the significance of paying these contributions on time and preferably in advance, and recently we have received a lot of feedback from clients, and our network, that these payments can get delayed, especially closer to the due dates.

As a business owner, it’s your legal obligation to contribute a minimum of 10.5% of your employees’ ordinary time earnings to their chosen superannuation fund. This must be paid by the quarterly due dates, which are as follows:

It’s important to note that these due dates are the latest dates by which the contributions must be received by the superannuation fund. To ensure your contributions are made on time, it’s best to make your payments well in advance of these due dates.

We recommend you should be scheduling these payments at least 2 weeks ahead of the deadline. To make this even easier, please note that these payments can be made weekly, fortnightly or even monthly.

In fact we encourage paying the Superannuation payments at the same time as the wages or salaries for your employees. This approach ensures that you are meeting your obligations as an employer. It will also avoid having a large sum of payment make a dent in your cash flow. Of course, if you are using the Profit First system, you would have already put aside the cash into your designated account. If you wish to discuss how Profit First can assist you in this, please reach out to Nathan or myself.

Failing to meet these due dates can result in severe consequences for your business, including penalties, legal action, and even prosecution. By making your payments in advance, you can ensure that your contributions are received on time and avoid any potential issues.

Meeting your superannuation obligations is not only a legal requirement but also essential for the financial well-being of your employees. These payments provide your employees with a reliable source of income in their retirement years, so by meeting your obligations on time, you’re ensuring your employees receive the necessary contributions to their superannuation accounts.

In addition to the legal and ethical obligations, meeting your superannuation obligations on time can also have tax benefits for your business. Employers who make their superannuation contributions in line with the ATO’s deadlines can claim the payments as a tax deduction. This deduction can help to reduce your business’s taxable income and, in turn, reduce your tax liability.

Paying your Superannuation Guarantee contributions in advance of their due date is essential to avoid legal penalties, provide financial stability for your employees, and enjoy the tax benefits of contributing on time.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

FULL DISCLAIMER:

The information provided by our firm is of a general nature and does not take into account your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness, or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

5 Reasons to contact your Accountant: Marriage Breakdown

Hey guys, Nathan here.

I do want to talk about a rather sensitive topic, and as an Accountant I have seen first-hand that going through a marriage breakdown can be a difficult and emotional time. During this time, it is important to seek professional help to ensure that your financial affairs are in order.

My team and I have been discussing a lot about why you should contact an accountant, and in this blog, I would like to discuss the 5 reasons why you should consider contacting your accountant during a marriage breakdown.

1. Property Settlement

One of the most important aspects of a marriage breakdown is the division of property.

We can help you understand your financial position and provide advice on how to approach property settlement negotiations. We can also help you calculate the tax implications of any property settlements and ensure that all tax obligations are met by both parties.

2. Asset Protection

If you are a business owner, having a conversation with us can help you protect your assets during a marriage breakdown. We can provide advice on the best way to structure your business to minimise the impact of a property settlement. We can also help you review your insurance policies over all the assets to ensure that you have adequate coverage in the event of a claim.

3. Financial Planning

Going through a marriage breakdown can have a significant impact on your financial position.

We can help you review your financial plan and make any necessary adjustments to ensure that you remain on track to achieve your financial goals. We can also provide advice on budgeting, debt management, and investment strategies.

4. Superannuation

Superannuation is often a significant asset that needs to be considered during a marriage breakdown. We can provide advice on how superannuation is treated in the event of a property settlement and help you understand your superannuation entitlements. We can also provide advice on how to maximise your superannuation contributions and ensure that you are on track for a comfortable retirement.

In most cases we would also recommend talking to your Financial Planner to make sure all your Superannuation and Financial Planning goals are being taken care of.

5. Taxation

A marriage breakdown can have significant tax implications. We can help you understand the tax implications of any property settlements, spousal maintenance payments, and child support payments. We can also provide advice on how to minimise your tax obligations and ensure that you are compliant with all tax laws.

Going through a marriage breakdown can be a challenging time, but seeking professional help can make a significant difference.

We can provide you with valuable advice and support to ensure that your financial affairs are in order. We can help you navigate the complex financial issues that arise during a marriage breakdown and ensure that you are on track to achieve your financial goals.

Remember, it is always better to seek professional advice early on to avoid any potential financial issues down the track. If you are going through a marriage breakdown, please feel free to contact us. We are there to help you through this challenging time and ensure that your financial affairs are in order.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

Disclaimer:

The information provided by NGR Accounting is of a general nature and does not take into account your specific financial circumstances, needs, or objectives. The information is not intended to be relied upon as specific advice and should not be treated as such. Before making any financial decisions, we recommend that you seek professional advice tailored to your specific circumstances.

Whilst every effort has been made to ensure the accuracy of the information provided, we do not guarantee its accuracy, completeness, or suitability for your intended use. We are not liable for any loss or damage resulting from your reliance on the information provided.

Our firm is not responsible for the content of any third-party websites that may be linked to or from our website. The inclusion of any links does not imply our endorsement of the website. It is your responsibility to evaluate the accuracy, completeness and usefulness of any information provided by these third-party websites.

By accessing or using the information provided by our firm, you acknowledge and accept the terms of this disclaimer.

Updated: 28th April, 2023

JM

10 Reasons why you should talk to your accountant: Cash Flow Forecasting

Hey guys, Nathan here.

As an accountant, I know that business owners should know that managing cash flow is crucial for the survival and success of any business.

Cash flow forecasting is a tool that can help you understand your business’s cash position now and into the future by analysing upcoming income and expenses. Cash flow forecasting can also be a complex process that can sometimes require the expertise of an accountant, like me, when you start setting one up.

In this blog, I will discuss 10 reasons why you should talk to your accountant when setting up a cash flow forecast for your business.

1. Do you have financial goals you want to achieve?

An experienced accountant can help you set financial goals for your business. By analysing your business’s financial performance and market conditions, your accountant can help you set realistic financial targets and create a cash flow forecast that aligns with your business goals.

This can help you plan and allocate resources efficiently and effectively.

2. Have you got an established financial system?

Setting up a financial system is a crucial step for any business. As your accountant, we can help you establish a financial system that suits your business’s needs and goals. This can include setting up an accounting software, creating financial statements, and implementing financial policies and procedures.

For more information, check out our previous post on 10 Reasons Discuss Setting up your Accounting Software with your Accountant.

3. You want to make sure you’re maintaining compliance requirements.

As a business owner, you need to comply with various tax and financial regulations. We can help you stay compliant with these regulations by ensuring that your cash flow forecast is accurate and up-to-date. We can also help you prepare and submit your tax returns and financial statements on time.

4. Do you know what you’re looking for with your cash flow?

We can help you analyse your cash flow and identify areas where you can improve. By understanding your business’s cash inflows and outflows, we can help you pinpoint problem areas and create a plan for solving them. This can help you improve your business’s cash flow and ensure its long-term financial sustainability.

5. Creating a cash flow forecast

We can help you create a cash flow forecast that accurately predicts your business’s future cash inflows and outflows.

This can help you make informed decisions about your business’s financial resources and plan for any potential cash shortfalls or surpluses.

6. Do you need help managing your business debt?

If your business has debts, we can help you manage them effectively. By analysing your cash flow and financial statements, we can help you create a debt management plan that minimises your interest payments and maximises your cash flow.

7. Are you looking at making investment decisions in the future?

We can help you make investment decisions that align with your business goals and cash flow forecast. By analysing your financial statements and market conditions, we can help you identify investment opportunities that maximise your returns and minimise your risks.

8. Are you planning for future growth of the business?

If your business is growing, we can help you plan for this growth by creating a cash flow forecast that considers your projected revenue and expenses. This can help you plan for any necessary investments, such as hiring new staff or expanding your operations.

9. Are you wanting to identifying tax savings?

Your accountant can help you identify tax savings opportunities that can help you reduce your tax liabilities and maximise your cash flow. This can include identifying eligible tax deductions, maximising depreciation deductions, and creating tax-efficient investment strategies.

10. Do you need us to provide financial advice?

Lastly, we can provide you with financial advice based on their expertise and experience. Whether you need advice on managing your cash flow, creating a financial plan, or making investment decisions, we can provide you with valuable insights and guidance.

Cash flow forecasting is an essential tool for any business owner. By talking to the team at NGR Accounting, you can ensure that your cash flow forecast is accurate, up-to-date, and aligned with your business goals. We can provide you with valuable insights and guidance that can help you improve your business’s cash flow and ensure its long-term financial sustainability.

If you have any questions, please feel free to contact NGR Accounting at 02 9011 6669 or via email at info@ngraccounting.com.au

Updated 19th April 2023

JM

10 Reasons to Discuss Setting up your Accounting Software with your Accountant

Hi everyone, Sue here, your Xero Hero, and I wanted to discuss implementing your Financial Accounting Software.

I understand that as a business owner, managing finances can be a daunting task. One way to make it easier is by using accounting software, but it’s important to set it up correctly from the start. That’s why it’s recommended to speak to your accountant when setting up your accounting software. In this blog, I want to discuss 10 reasons why speaking to your accountant is crucial when setting up your accounting software.

FBT – What is it, and what do you need to know?

Hey guys, Nathan here.

As an accountant, I can understand that lodging your Fringe Benefits Tax (FBT) can be a daunting task for many of my clients.

I want to outline the key responsibilities that clients need to be aware of, import dates to keep in mind, and… where to find more information. So, let’s go.